As the financial services landscape rapidly embraces AI, staying ahead means not only understanding current trends but effectively leveraging them. The Artificial Intelligence Services – The Nordic AI-volution: Advancing from practice to performance conference is designed to spotlight essential strategies for FS leaders eager to implement AI effectively, transition smoothly from AI concepts to tangible ROI and navigate the ethical considerations essential in tech deployment.

Unveiling AI success pathways

Learn directly from top-tier experts as they outline actionable strategies leaders must adopt to integrate AI into their financial operations successfully. This deep dive into pioneering AI applications and methods will reveal how you can shape a future-focused strategy that not only incorporates AI innovations but also drives measurable financial gains.

Building ethical and responsible AI frameworks

The conference also focuses on the critical importance of ethics and responsibility in AI applications within financial services. Discover how to approach AI with a principled foundation, ensuring your foundation, ensuring your endeavours in AI guard against bias, uphold data privacy and maintain trust. Engage with specialists who are forging the path for responsible AI, providing valuable insights into creating robust frameworks that support ethical operations.

Networking and knowledge exchange

Capitalise on the opportunity to connect with the region’s leading tech innovators, thought leaders and industry visionaries. Each interaction promises to enrich your perspective, offering real-world advice and insights into groundbreaking case studies. Expand your professional network, interact with peers and access the latest industry research to stay on the front lines of technology and finance.

Don’t let this chance slip by; secure your place at the forefront of AI in finance. Register now and transform your AI challenges into opportunities with insights from the conference.

WHAT TO EXPECT FOR 2025

- Gather expert insight from an impressive speaking faculty, 60% of which are director+ level from the biggest FS companies in the industry.

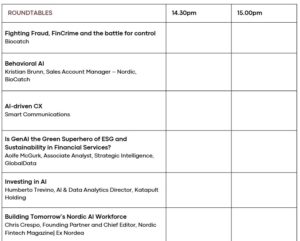

- Discover the latest innovation and updates from a remarkable agenda, which covers both front-end and back-end themes.

- Enjoy a day of invaluable networking opportunities.

- Be part of timely and relevant conversations and hear about topics that are trending in the industry, including The future of AIoT in banking, creating GenAI roadmaps, responsible use of AI and more.

| 150+ Attendees | 15+ Exhibitors | 25+ Speakers | 75% Attendees at Director+ level |

| 150+ Attendees | 15+ Exhibitors | ||

| 25+ Speakers | 75% Attendees at Director+ level |

Back

Back